This spring, investors mounted an unprecedented challenge for climate action at the largest U.S. fossil fuel insurers, proposing a number of independent resolutions and spotlighting key director votes at AIG, Berkshire Hathaway, Chubb, The Hartford, and Travelers.

Key Takeaways

- U.S. insurers faced unprecedented challenges from investors who are increasingly concerned about the risk that climate change poses to insurers and about insurers’ contributions to climate change. In total, eight climate-related shareholder proposals were filed.

- Two resolutions requesting a report from companies outlining their plans for emissions reductions in line with the Paris Agreement’s goal of limiting warming to 1.5ºC passed (Chubb, Travelers), one with a resounding 72% support (Chubb).

- Three resolutions calling for no more underwriting of new fossil fuel supplies received less support (at Chubb, The Hartford, and Travelers), although all three qualified for re-filing next year. Advocates are calling the vote percentages a good start, especially since this year is the first time they have been filed. While these results demonstrate the growing investor concern with fossil fuel business as usual, major shareholders, including the biggest asset managers in the world appear to be missing in action.

Why Insurance?

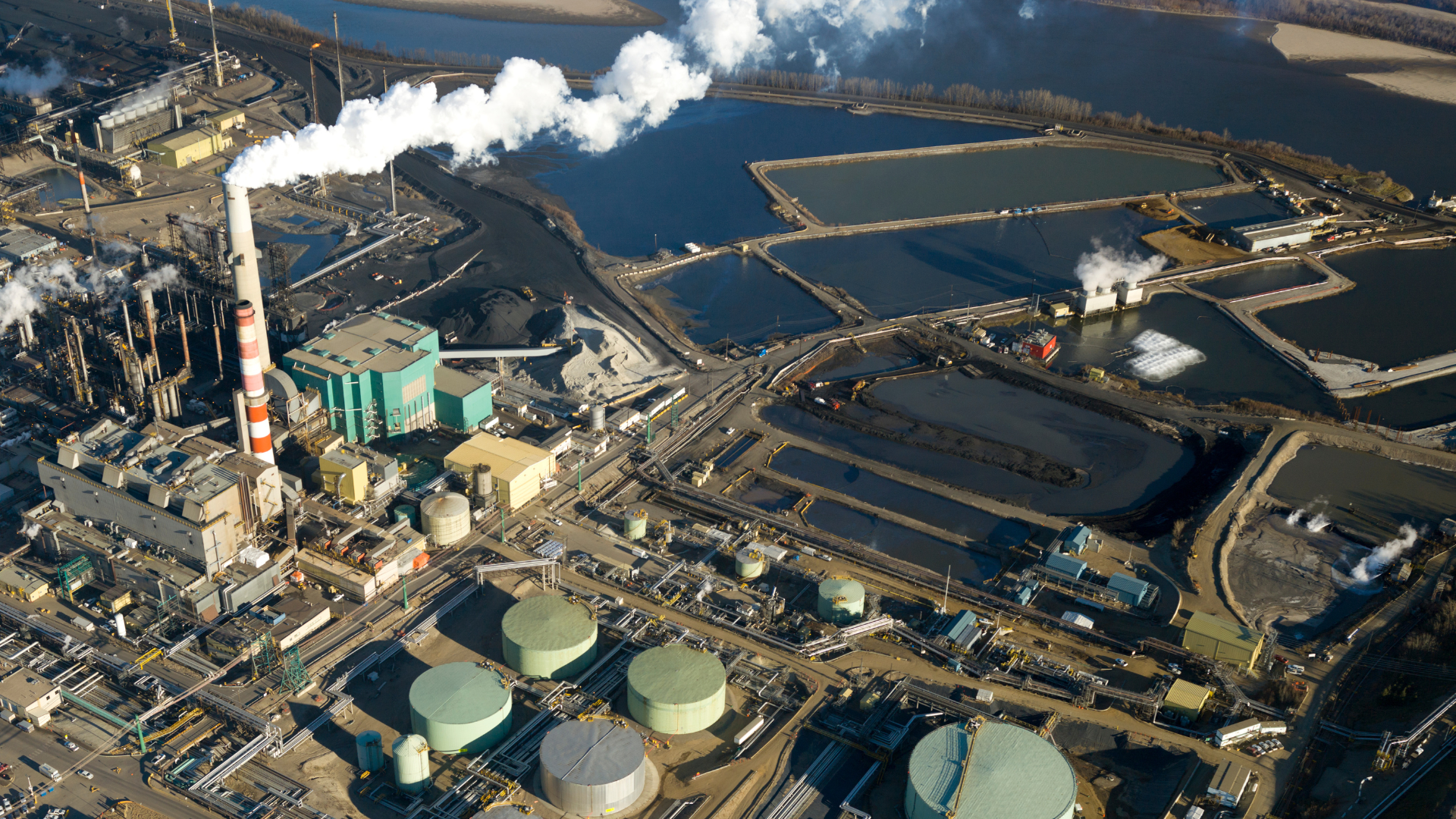

U.S. property and casualty insurers are lagging far behind their global peers when it comes to reducing emissions and curbing underwriting for fossil fuels, undermining global efforts by the insurance industry to tackle the climate crisis. The U.S. industry is crucial to these efforts, as it makes up the largest share of oil and gas underwriting in the world and enables the expansion of fossil fuel infrastructure that the climate cannot afford.

These companies name climate change as a top global risk to the insurance industry and say they are taking steps to tackle their own carbon footprint. However their current climate policies are far from aligning with the consensus from climate scientists, energy modelers, and political figures that there can be no expansion of coal, oil, and gas supplies.

Investors Issue Key Recommendations

Investors’ scrutiny of fossil fuel financiers is growing. Alongside investor-led pressure to hold U.S. banks accountable for their fossil fuel financing, investors took a close look at climate policies from U.S. insurers and issued their own recommendations:

- Shareholder advocacy firm As You Sow filed a proposal that requested that Berkshire Hathaway, Chubb, The Hartford, and Travelers publish a report outlining the companies’ plans for emissions reductions in line with the Paris Agreement’s goal of limiting warming to 1.5ºC, which requires net-zero emissions by 2050. In March 2022, The Hartford released a net zero goal publicly, and so As You Sow withdrew the proposal there.

- Green Century Capital Management filed a resolution with Chubb, The Hartford, and Travelers, calling on the insurance giants to “adopt and disclose new policies to help ensure that its underwriting practices do not support new fossil fuel supplies, in alignment with the International Energy Agency (IEA)’s Net Zero Emissions by 2050 Scenario.”

- The Presbyterian Church USA filed a similar resolution with AIG as well, which they withdrew following AIG’s March 2022 adoption of coal, tar sands oil, and Arctic energy underwriting restrictions and a goal to achieve net-zero emissions across underwriting by 2050.

- Shareholder advocacy organization Majority Action filed an exempt solicitation to recommend against Chubb’s CEO, Board Chair, and Chair of the Executive Committee Evan G. Greenberg and Chair of the Risk and Finance Committee Olivier Steimer. They cited that Greenberg and Steimer failing in their oversight responsibilities to address escalating physical and financial risks posed by climate change creates systemic unhedgeable risks to long-term investors.

Management recommended voting against every single one of the climate proposals, all of which moved forward to a vote. In fact, Chubb, The Hartford, and Travelers tried to get the resolutions dismissed, filing unsuccessful challenges with the Securities and Exchange Commission to remove them from the ballot.

The Vote Results?

From April through May 2022, shareholders gathered in person and virtually at the annual general meetings (AGMs) of major U.S. insurers. Climate was at the top of the agenda.

At The Hartford’s online AGM, the majority of Q&A time was spent addressing the company’s climate record. During Chubb’s meeting in Switzerland, protesters in Zurich and NYC took action in the streets targeting CEO Evan Greenberg. In Hartford, CT, activists asked questions inside Travelers’ meeting, while rallying outside with banners and speakers.

Meanwhile, shareholders issued a clear mandate for climate action, making it impossible for insurers to ignore these issues.

Massive Support for Emissions Reductions Plans

In a clear rebuke to management’s recommendations, As You Sow’s proposal asking insurers to issue a report on its plans for reducing greenhouse gas emissions in line with 1.5ºC passed with a whopping 72% at Chubb and more than 55% at Travelers. At fossil fuel-entangled Berkshire Hathaway, 47% of votes cast by independent shareholders supported the measure.

These votes send a clear signal to the insurance giants that their current climate policies are insufficient. Investors demand clarity and disclosure on their emissions reductions plans.

But at the AGMs of The Hartford, Chubb, and Travelers, investors faced a clear litmus test on climate action: would they vote to push beyond long-term net zero policies and Paris-alignment pledges for a policy to end underwriting fossil fuel expansion?

No Fossil Fuel Expansion Falls Short on the Ballot, but Earns Critical Backing

In contrast to the broad support for the emissions reductions plans, the proposals on no fossil fuel expansion did not pass. At The Hartford, just 8.8% of the votes cast backed the ‘no fossil fuel expansion resolution.’ At Chubb, it fared significantly better with more than 19% of the vote. At Travelers, it earned 13%.

Although these results are nowhere near a majority of shareholders, they are significant for a few reasons:

- The votes cast represent billions of dollars in shares. At Chubb, approximately $17.1 billion worth of shares voted in favor of the proposal on fossil fuel expansion

- The resolutions earned the support of some major investors, including the New York State Common Retirement Fund, the third largest pension fund in the country.

- This was the first time that these resolutions – or anything like them – had ever been filed at these insurance companies, and they easily surpassed the threshold to be re-filed again next year (5%). Plus, any proposal that receives more than 10% is considered hard for a company to ignore.

While these results demonstrate the growing investor concern with fossil fuel business as usual, major shareholders, including the biggest asset managers in the world appear to be missing in action.

Big Asset Managers Miss Big Opportunity

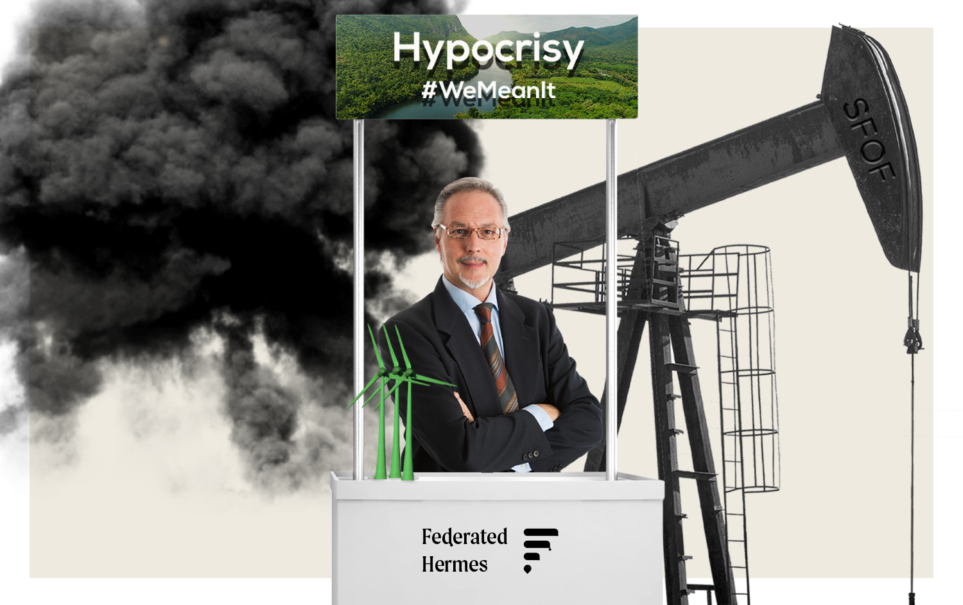

Though the exact details on who voted for what are not yet available, the vote counts suggest that the world’s largest asset managers did not support Green Century’s no fossil fuel expansion resolutions. In fact, BlackRock, who has touted its own net-zero goal and has previously spoken out about the need to support climate proposals up for a vote at companies in its investment portfolio, made clear that it would not be voting for these proposals in advance of the AGMs.

In a memo published by BlackRock Investment Stewardship, the asset manager alleged that any climate resolutions that ask companies to make changes to their business model were too “prescriptive.” But the reality is that the demand to stop insuring fossil fuel expansion is not too prescriptive, it is in line with the scientific consensus for what is needed to limit global warming to 1.5ºC. Furthermore, it does not translate to shutting all fossil fuels off overnight, although management tried to characterize it that way in their arguments against the proposal.

Other major asset and wealth managers, pension funds, and financial firms, many of whom claim to be sustainability leaders, also did not support the fossil fuel expansion resolutions, including the California State Teachers’ Retirement System (CalSTRS) and other big pensions. Over the next few months, we will be focusing on accountability, as final vote counts are released and individual investors publish their own voting records.

Looking Ahead

Although AGM season is nearing a wrap, investors must continue to stay engaged and hold the U.S. insurance industry accountable for its abysmal climate record. This means spotlighting the role that these companies play in underwriting new fossil fuel infrastructure and pushing the industry to catch up to best practice policies from global peers to rule out insuring new oil and gas projects.

It also means broadening the movement of investors that are tracking these issues and calling for action. We need more asset managers, pension funds, retail investors, and foundations to step up and voice their concerns, file resolutions, recommend votes against directors, and cast their votes in favor of ambitious climate action. There is no time to waste.

Share