Global electricity giant, General Electric (GE), is facing a shareholder proposal (Proposal 4) at its 3 May 2023 AGM asking the company to justify how its power business aligns with the International Energy Agency (IEA)’s Net Zero emissions by 2050 scenario, prior to the spinoff of its power sector into “GE Vernova.” Investors are asked to vote for this proposal supporting more disclosure from GE.

—

Environmental finance organization, Market Forces, and Newground Social Investment, acting on behalf of a client and GE shareholder, have filed the proposal seeking disclosure from GE on how action on climate change would impact its power business.

GE claims to create one third of the world’s electricity and plans to spin off its power business into a company called GE Vernova, which emphasizes new green credentials. Yet public reports connect the company with almost 25 new gigawatts of liquified natural gas (LNG) power projects in Vietnam and Bangladesh, which will operate until 2050 and beyond.

Key Points

- Summary of Proposal: The proponents request GE provide an audited report to address how application of the International Energy Agency’s (IEA) Net Zero Emissions by 2050 pathway (NZE) would affect the assumptions and estimates that underlie GE’s valuation and expected cash flow assessments.

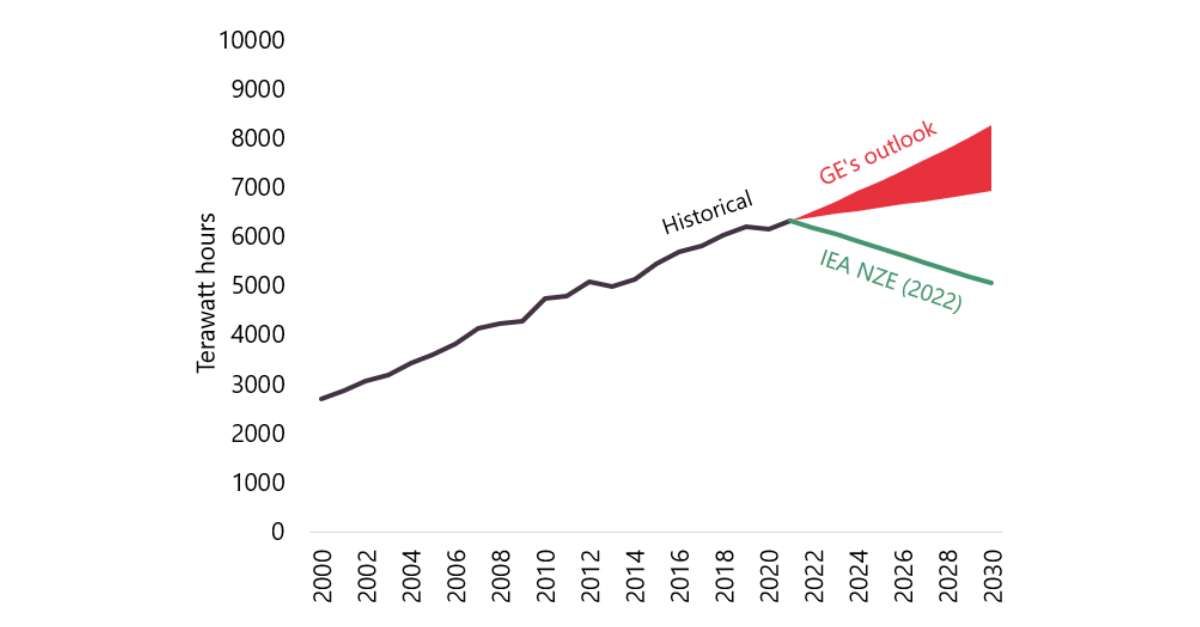

- This proposal seeks information investors need to assess GE’s position prior to the GE Vernova spinoff as GE’s gas strategy is misaligned with its own net zero by 2050 commitment, doubling down on gas power contrary to the gas demand modelling provided by reputable net zero emissions scenarios.

- This misalignment and proposed gas buildout present a reputational and financial risk for the company and its investors, and sees GE placing too much faith on unproven technologies and missing out on wind power opportunities, with gas acting as a barrier to renewable penetration in emerging markets.

- Shareholders voting for this proposal would provide a clear signal to GE that they require information related to asset resilience to a net zero emissions by 2050 pathway, and would ensure that GE will provide this information through disclosure related to GE Vernova.

Out of line with net zero demand scenarios

The GE resolution follows similar shareholder proposals that demand disclosure on asset resilience and climate risk being put to companies such as Exxon and Chevron, which garnered 51 per cent and 38 per cent support from investors, respectively, reflecting investors’ concern about these issues. GE itself has failed to respond to investor demands in a 2021 shareholder proposal to align corporate strategy with the Paris Agreement and net zero emissions by 2050, a proposal supported by 98% of GE’s shareholders.

Newground Social Investment and Market Forces are concerned GE is relying on gas demand scenarios that fail to meet net zero emissions by 2050. This reliance on gas demand assumptions could cause the company to lose substantial capital invested in assets which may become stranded.

LNG buildout’s impact on Bangladesh and other emerging markets and associated risks to GE

Meanwhile, there is a growing tide of opposition to new GE LNG power projects in countries, including Bangladesh, where gas prices have made electricity unaffordable for millions of people. Spot LNG prices have almost quadrupled between January 2021 to June 2022. Through the second half of 2022, the Bangladesh government could not afford to import LNG due to record high prices in the spot market. An Institute for Energy Economics and Financial Analysis study also finds 66% of Bangladesh’s proposed gas power capacity is unlikely to be built, a situation only exacerbated by long-term demand destruction caused by high gas prices since.

The coastal region of Chattogram in Bangladesh, where GE is proposing to build its LNG to power projects, is rife with stories of local community members’ displacement and loss of livelihoods due to the construction of fossil fuel projects. These present a reputational risk to GE, its spinoff and its investors.

![Quote 2 [Image of farmer, standing hands in front of him, on a grassy background near water; quote overlaid] "If these lands are taken away for [LNG] projects, the people of Moheshkhali won't have much to do for livelihood," Mohammad Rubel, salt and fish farmer, Moheshkhali, Chattogram](https://climate-votes.org/wp-content/uploads/2023/03/Quote-2.png)

With renewable energy tariffs getting cheaper and outcompeting gas, GE and its GE Vernova spinoff faces financial risk from its plans for expensive and volatile fossil gas projects – not just through equity ownership, but also through gas turbine supply and servicing earnings. Yet GE fails to disclose adequate information for investors to properly assess the company’s transition risk exposure and management practices.

At the upcoming GE AGM on 3 May 2023, investors are therefore urged to vote FOR Shareholder Proposal No. 4 — Assess Energy-Related Asset Resilience (No. 8 on Definitive Proxy Solicitation Materials).

Share