Norway’s Oil Fund has voted to back Shell’s directors on all points at its AGM. Shell’s third largest shareholder has chosen not to join the 27 institutional investors which filed a resolution calling for Shell to align its climate targets with the Paris Agreement.

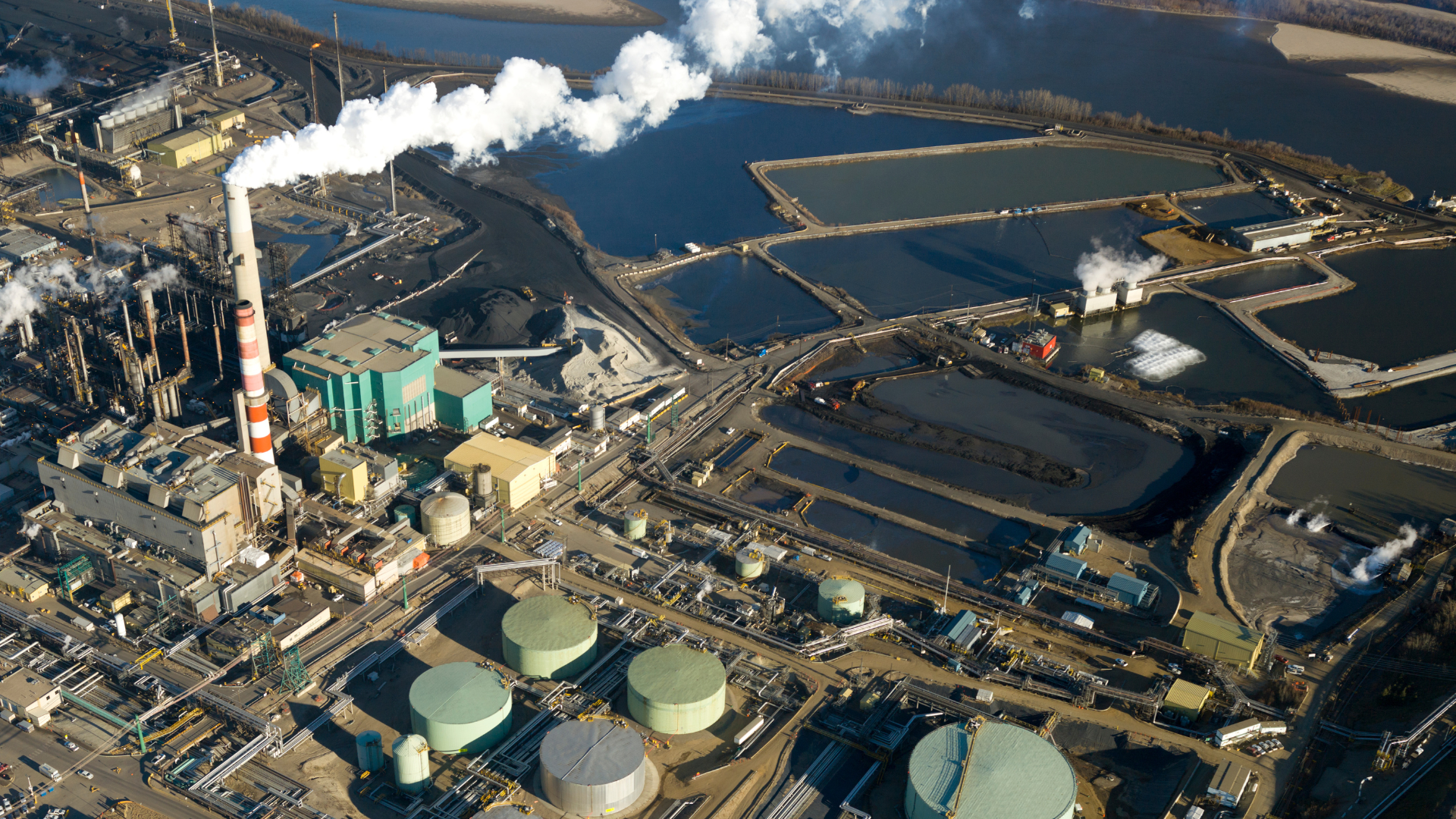

This is part of a pattern. For over ten years Norway’s Fund has been holding talks with Shell on human and environmental devastation here in the Niger Delta with minimal results that we can see.

Norway’s Fund is Shell’s third largest shareholder, so it should be in a position to get things done.

Yet NBIM has consistently missed opportunities to vote for climate at oil and gas company AGMs. A recent report by Norwegian organisation Future In Our Hands showed that last year NBIM voted against climate resolutions at the AGMs of BP, Shell, TotalEnergies and Marathon. All of these companies lack adequate climate targets according to the Climate Action 100+ initiative that brings together hundreds of major investors. Many prominent investors including Nordea, Storebrand, DNB and KLP voted for the climate resolutions that NBIM rejected.

Anja Bakken Riise, the CEO of Future in Our Hands said that “NBIM’s failure to endorse climate resolutions in line with internationally agreed goals undermines its role as a steward of sustainable finance and risks its reputation as a leader in responsible investment.”

I agree.

NBIM’s Climate Action Plan is full of good intentions, and the Fund’s CEO, Nicolai Tangen, said recently “we are quite strong on how we vote on the different issues”.

Today’s announcement in fact shows a worrying weakness from the Fund. It has a very long way to go to fulfil the expectations and demands raised by dozens of Nigerian organisations at last year’s People’s AGM held in Abuja.

So far the Fund has been engaging with Shell for over ten years on environmental and ethical concerns in the Niger Delta. Late last year it extended that deadline for a further two due to lack of progress, and said that it will act to ensure that Shell exits the Niger Delta responsibly as it sells its onshore assets.

If the Fund is to be effective in that endeavour, and in its aims to keep the world within safe climate limits, it will have to find the courage to publicly challenge Shell and other big oils, and to use its full voting power and voice to create change. At Shell’s AGM NBIM disappointed us terribly. All eyes are on Exxon’s AGM next week. We are waiting to see if NBIM will join major investors holding Exxon’s board accountable and making a public stand for shareholder rights.

Share