Considering its size and influence, the UN-convened Net Zero Asset Owner Alliance (NZAOA) has a unique opportunity to ensure no more fossil fuel expansion and transition companies to a 1.5 pathway. For this to be successful, it requires all members to leverage their power at upcoming shareholder meetings, to urgently align on escalation strategies, and define consequences for asset managers and corporates who fail to act.

The second edition of its Target Setting Protocol is now the latest map that guides this group of 70 asset owners with a combined US$10.4 trillion AUM on how to reach their net zero commitments.

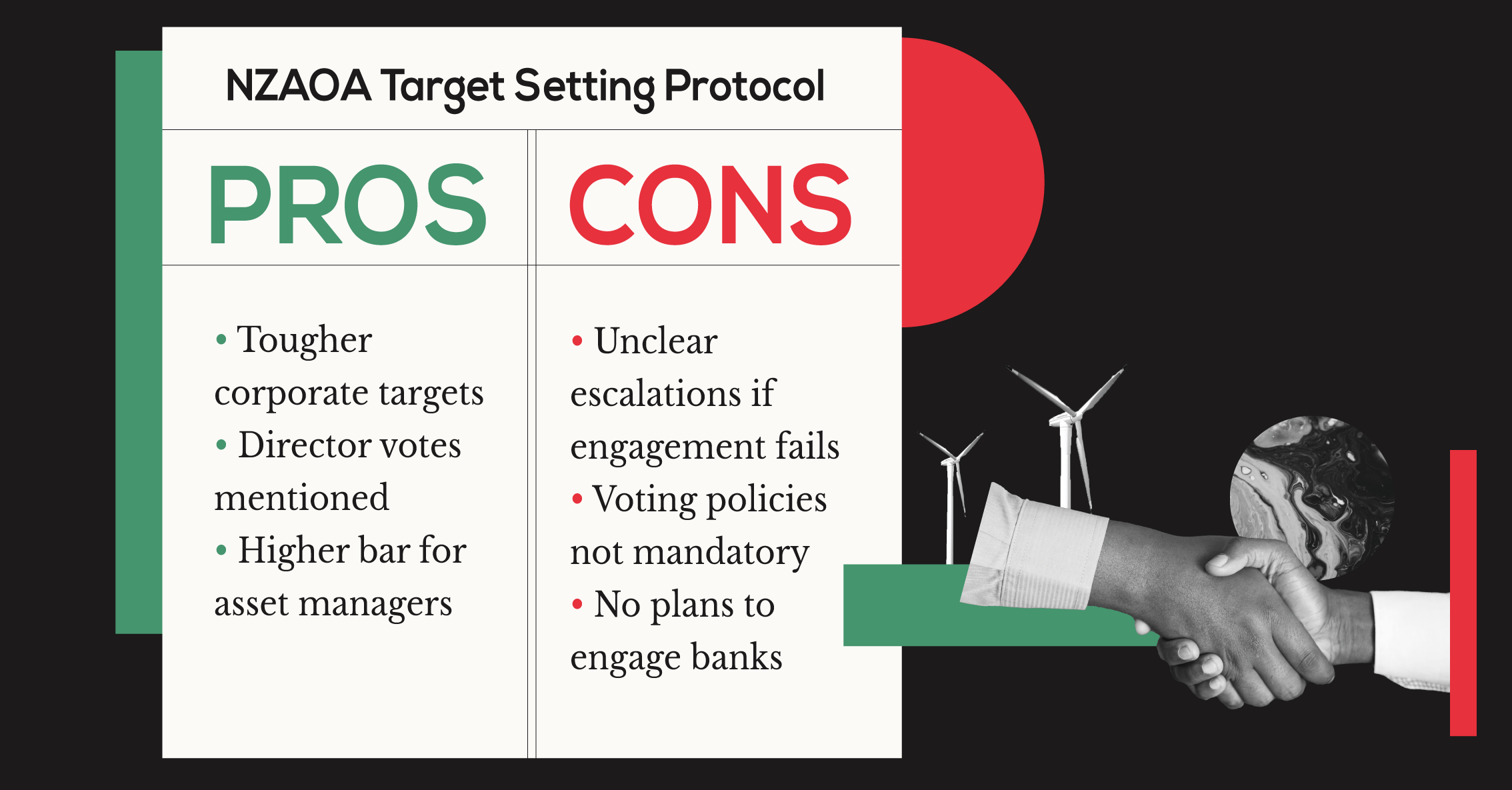

Overall, it does not disappoint and broadly aligns with IPCC’s no/low overshoot 1.5℃ scenarios, despite shortcomings on some key topics and lack of accountability mechanism. It raises the ambition of its 2025 emissions reduction target range to 22% and 32% and sets the 2030 target range to 49% to 62%. It also added seven new sector-specific targets. Infrastructure assets is one of them.

Yet, we all know from our own experience of setting new year resolutions, that goals that are not accompanied by immediate actions will only remain distant dreams.

Here are 3 immediate actions NZAOA members can take to turn ambitions into reality.

#1. End support for fossil fuel expansion and prioritize engaging with all financial institutions to do the same.

It is encouraging to see the NZAOA took a firm position on fossil fuel financing in the updated Protocol. It requires members to “support the phase-out of fossil fuels required by 1.5℃ scenarios” and “not provide new finance to infrastructure assets whose purpose or emissions cannot be aligned with the Alliance net-zero ambitions.” It references the International Energy Agency (IEA) Net Zero by 2050 (NZE2050) and One Earth Climate Model (OECM) as the latest climate science to follow and says the recommendation “holds especially for investments in coal, oil, and gas.” (pg.53)

Now, all members should follow through by action. Few members have recently taken steps. The Danish pension fund AkademikerPension announced it will divest from fossil fuel bonds this year. French investor CNP Assurances committed to ending new investments in companies developing new oil & gas projects.

In addition to addressing its own investments, the alliance needs to make fossil fuel phase-out a key engagement outcome for all their investee companies and asset managers.

Because we know that without buy-in from all financial institutions, its endeavor to redline investments in fossil fuel infrastructure assets will have minimal impact in driving change in the real world. A number of recent studies on fossil fuel financing found exactly this: that financial institutions who are critical in the transition to a low carbon economy are still financing fossil fuel expansion and exploration. Few notable examples below:

- ShareAction research revealed 25 largest European banks together provided $55 billion to companies expanding oil & gas operations in 2021 with significant loopholes in phase-out financing to thermal coal-related activities.

- Insure Our Future 2021 Insurance Scorecard found that leading insurance companies continue to underwrite the expansion of the oil and gas industry without restrictions, and few in US & Asia continue to underwrite new coal insurance.

- University of Oxford researchers concluded ETF providers continue to purchase new bonds issued by carbon-intensive companies via the primary market, creating carbon lock-in and stranded asset risk.

#2. Align escalation strategies with net zero commitments and disclose voting records in a timely manner.

Engagement has been touted as the most important mechanism NZAOA asset owners could employ to deliver real world outcomes.

Yet, the NZAOA Climate Voting and Benchmarking report showed a disconnect between the climate voting practices of NZAOA members and their net zero engagement goals.

On a positive note, the updated Protocol provides improved guidelines to the engagement expectations of its members. It identifies common key asks to companies and asset managers. It also recommends members to “clearly define escalation procedures” and “use of votes to hold companies accountable when they are making unsatisfactory progress to address climate change.” It also calls for using NZAOA’s proxy voting guideline on climate in the “selection, appointment, and monitoring of their asset managers.”

It’s high time for net zero asset owners to follow through by laying out clear escalation policies that fit in line with the alliance’s commitments in time for 2022 proxy season. We also expect asset owners to publish their voting records promptly, whether they voted directly or via their fund managers.

#3. Establish an accountability framework for asset managers that clearly defines no/slow action consequences.

To the NZAOA, asset manager engagement is “one of the most important and impactful opportunities for asset owners.” (pg.61)

The updated Protocol provides improved guidelines and offers stronger language that requires members to use their influence to push asset managers to set 1.5℃ aligned reduction targets. But there is no guidance on what escalation pathways asset owners should take if engagement efforts fail with their fund managers.

The latest voting accountability reports confirmed that the largest asset managers including BlackRock and Vanguard, continue to lag behind peers when it comes to voting in favor of climate & ESG proposals at AGMs. Their director votes aren’t any better – they continue to support directors with poor climate track record.

Clearly, better guidelines are not enough at this point.

Instead, there needs to be an accountability framework for asset managers. What will net zero asset owners do if asset managers continue to vote against climate action and allow capital flow into fossil fuel expansion? Perhaps the Net Zero Asset Managers Initiative (NZAM) could serve as a platform where NZAOA can interject that accountability role.

Moreover, bold action is needed for asset owners to move these large asset managers. Here are a few examples:

- Asset owners can align climate voting intentions with asset managers by publicly stating their voting intentions and calling on asset managers to do the same.

- In addition to broad net zero alignment asks, SMART engagement requests, including minimum expectations around fossil fuel investments to their asset managers need to follow. For example, a minimum expectation could be that asset managers commit to no longer purchase corporate bonds issued for fossil fuel expansion.

- Finally, asset owners should explore innovative ways to incentivize asset managers to transition their portfolio to net zero sooner than later. One example could be tying asset manager fees with their climate stewardship performance and decarbonization milestones.

These are bold claims, but we are hopeful that the NZAOA will rise to the challenge.

Share