With scientists predicting that the climate will breach 1.5 degrees by 2027, investors are facing a wake-up call to start thinking about the role they can play in taking escalated action to fulfill their fiduciary duty and prevent global economic catastrophes resulting from climate change.

To encourage investors to implement escalation pathways, Majority Action, ShareAction, Australasian Centre for Corporate Responsibility (ACCR), Follow This, Reclaim Finance, Interfaith Center on Corporate Responsibility (ICCR), and Climate Votes held a webinar educating investors on tools they can use to escalate climate action, with experts in the field:

- John Hoeppner, Head of US Stewardship & Sustainable Investments, Legal General Investment Management (LGIM)

- Tim Smith, Lead Investment Stewardship Manager, Norges Bank Investment Management Time (NBIM)

- Ellen Quigley, Research Associate in Climate Risk & Sustainable Finance at Centre for the Study of Existential Risk, and the Advisor to the Chief Financial Officer (Responsible Investment) at the University of Cambridge;

- Lisa Lindsley, Director of Investor Engagement at Majority Action

What is an escalation pathway?

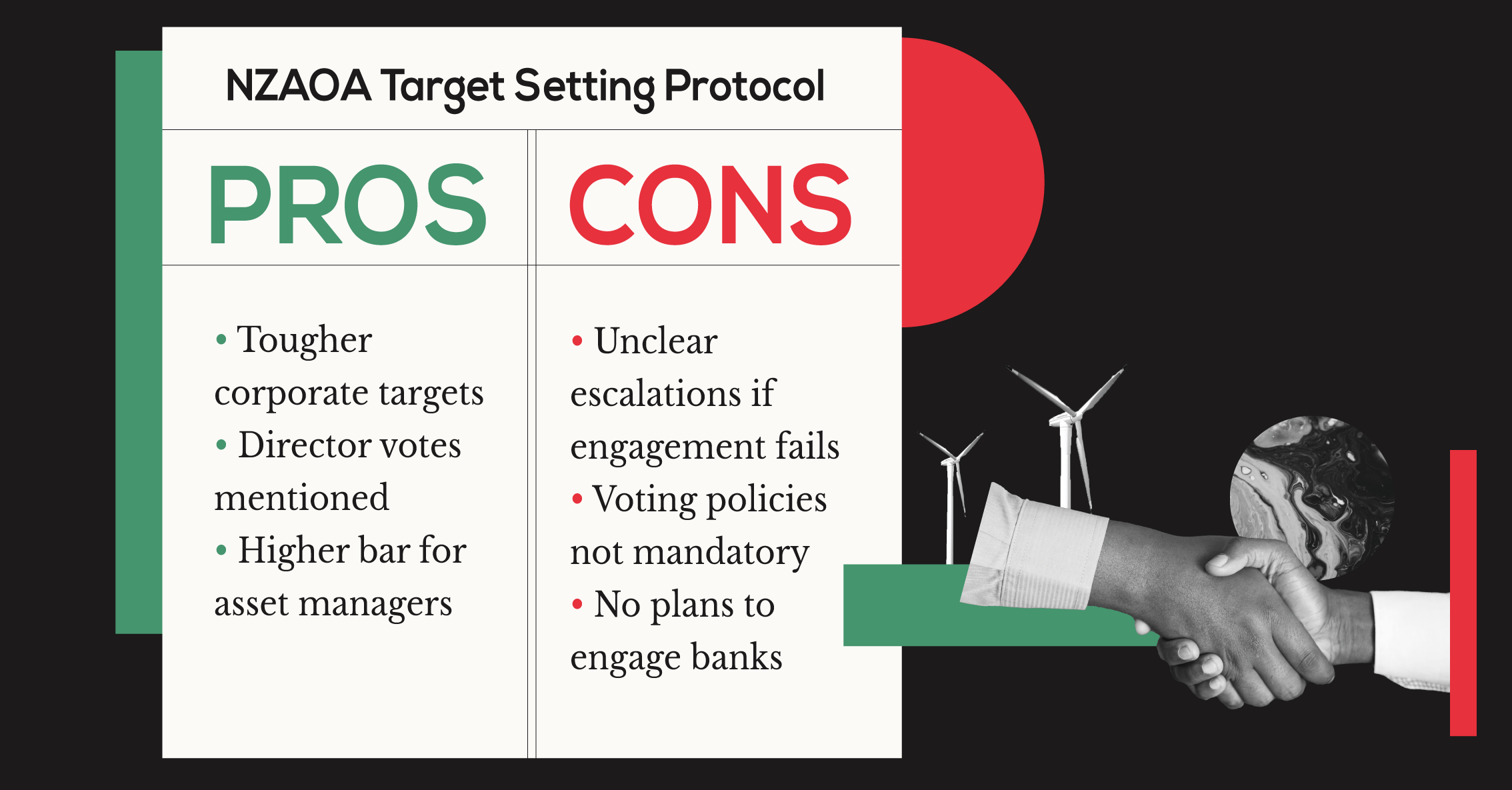

An escalation pathway is a set of time-bound tools to help institutional investors hold corporate boards accountable on climate related issues. These tools range from writing open letters, filing resolutions, and meeting with companies. But further action can look like this:

- Proxy voting policies that establish accountability for boards and auditors

- Publishing voting rationales

- Pre-declaring proxy voting decisions

- Evaluating litigation or divestment options

Escalation pathways in practice

During the webinar, we heard from speakers on how they’ve used escalation previously.

“When we took an action against ICBC in China, we took a voting consequence, and, actually, divestment consequence, that actually helped us unlock conversations that had stalled.” – John Hoeppner

John Hoeppner also recounted how LGIM targeted 80 companies, using time-bound calls to action to unlock critical conversations. When such companies failed to implement measures and progress marked by third-party indicators such as net-zero pathways wasn’t being made, LGIM didn’t shy away from taking voting consequences or even divesting when necessary. But that didn’t stop the companies within LGIM’s portfolio from engaging with the asset manager.

“Where we’re voting against a company, we’ll provide a rationale.” – Tim Smith

A similar approach was taken at NBIM, where the pension fund’s standards of climate action were based on principles laid out within their expectation documents. If companies failed to disclose progress towards these expectations, NBIM would pre-declare their voting intention and explain their reasoning behind it.

“Disclosure itself isn’t going to get us where we need to go…It would be more useful to think of it as a means for a much more ambitious ask.” – Ellen Quigley

Ellen Quigley of the University of Cambridge responded to this by putting forward the idea that disclosures alone won’t cut it. It’s time to think bigger, to apply pressure on companies failing to take sufficient climate action. Divestment and removal from stock indexes may be necessary steps in some cases. By combining multiple tactics and presenting the possibility of escalation, we can drive companies to take meaningful action.

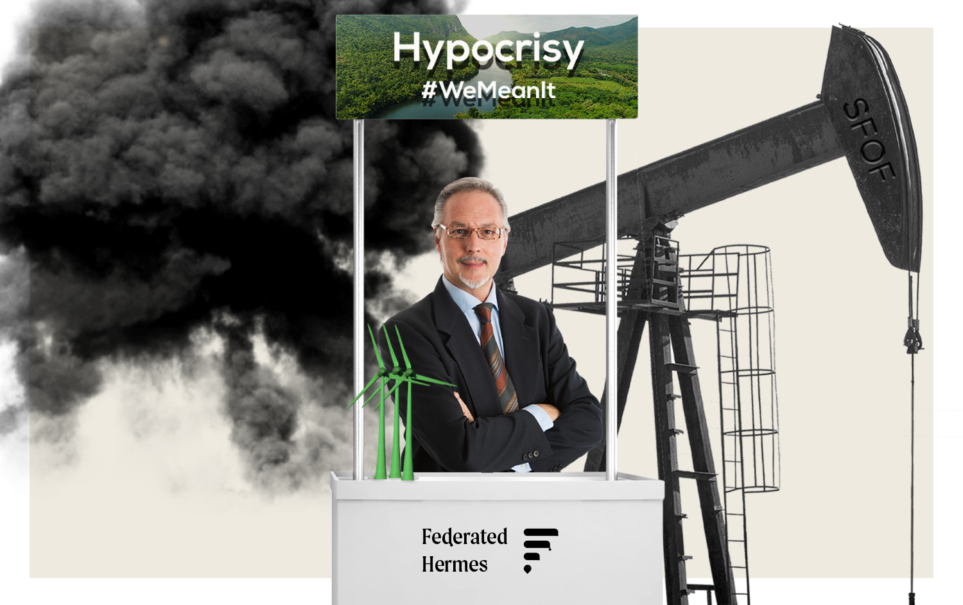

Analyzing State Street’s Major Step Backwards on Climate

Majority Action and the Interfaith Center on Corporate Responsibility (ICCR) have created a toolkit with draft letters to empower active investors and drive positive change for this exact reason. In addition, they held a follow-up webinar using SSGA as a case study to explain the avenues available to investors to implement escalation tactics.

As the number of shareholder resolutions focused on climate change has been increasing, conscientious investors are communicating their concerns to asset managers, emphasizing the importance of safeguarding the value of their investment portfolios through making headway on net zero targets.

“The components of an escalation pathway are not mutually exclusive. You can both vote against a director and file a shareholder resolution and have a call with a company and write a letter.” – Lisa Lindsley

Despite the progress made by active investors, a concerning development has emerged in the form of State Street Global Advisors (SSGA) 2023 proxy voting guidelines. These guidelines represent a material step backwards in addressing climate-related issues. This backwards step highlights the need for active stewardship to hold financial institutions, such as asset manager clients, accountable and demand more robust action to mitigate climate risks.

In the face of this challenge, exercising a layered approach to active stewardship and driving change from within the investment industry becomes even more crucial.

Active stewardship is not merely a symbolic gesture; it’s a method to drive tangible change. By engaging with relationship managers and senior management, investors can drive meaningful climate action.

Through collective action, active stewardship from investors can push their asset managers, urging them to align their strategies with the net zero pathways to protect their bottom line and the well-being of society.

But this discussion was so nuanced that capturing the expertise displayed and topics discussed and debated isn’t possible within a quick blog. Watch the first webinar back and let us know what you think on LinkedIn or Twitter.

Share