Two trends have reshaped institutional investing in recent years. One is the continued rise of passive investing strategies. The other is surging investor awareness of climate-related financial risk. It can be easy to imagine that these stories are separate. The broad-market nature of index investing, so the conventional wisdom goes, makes it unwise to adjust the strategy for looming issues like climate change and the clean energy transition. Accordingly, it can be tempting for investors to imagine their passive portfolios as exempted from demands for climate readiness.

Yet they ignore the climate emergency and the energy transition at their own peril. A wealth of new research is finding that passive investors stand exposed to poorer investment performance if they fail to act amidst this market transition — and that pathways towards action are beginning to emerge.

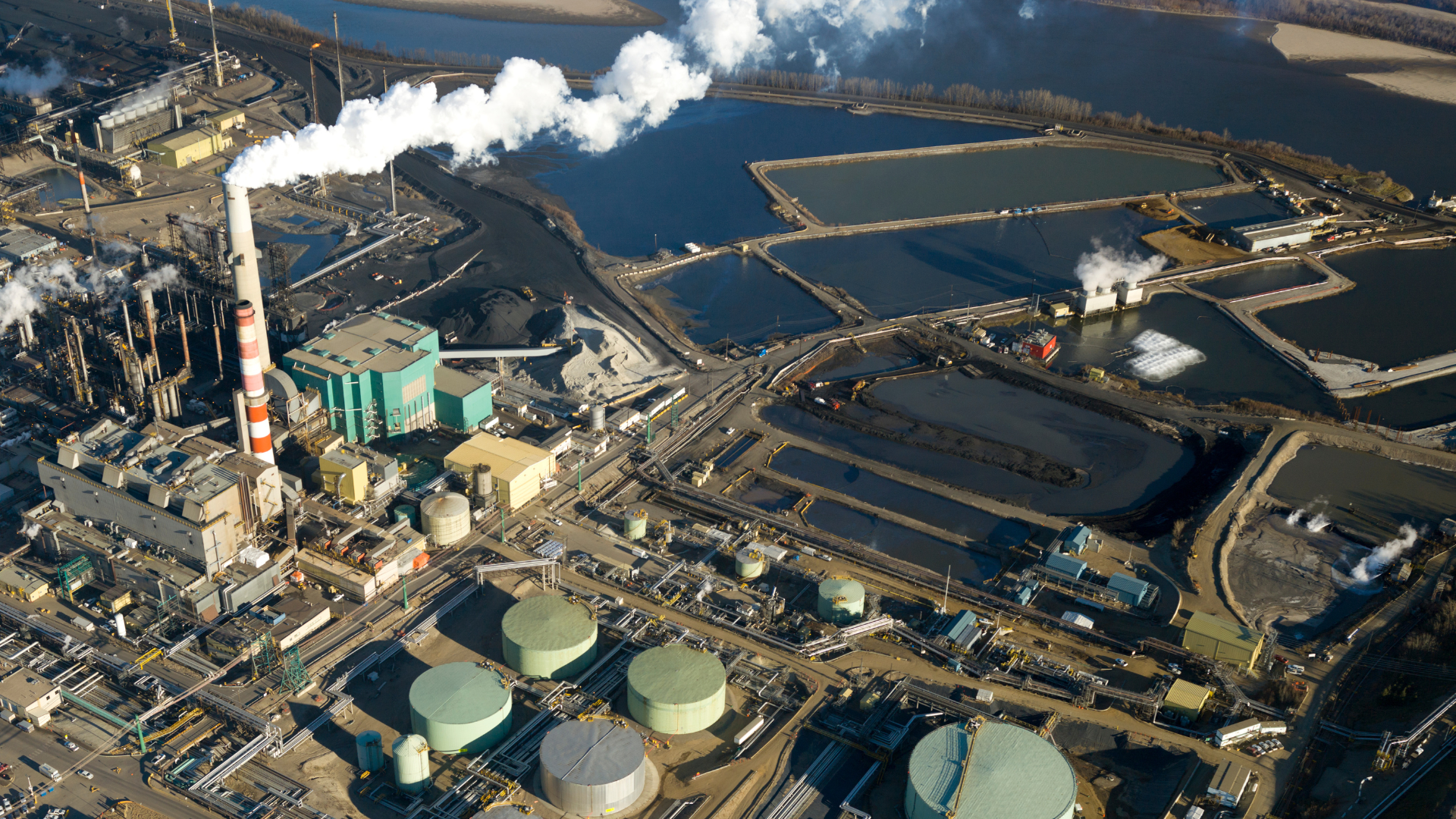

Take the case of fossil fuels in index funds. There was once an era when fossil fuels drove market returns, and when energy companies could comfortably link their core business model with economic growth writ large. In our recent report, Passive Investing in a Warming World, we at the Institute for Energy Economics and Financial Analysis examine just how different the picture is today. Fossil fuels finished second to last among market sectors last year. But it wasn’t just a bad year, but a bad decade: we find that fossil fuels dragged down stock market indices over the past 10 years and cost passive investors in the process. Looking at each of the major US broad-market indices — the S&P 500, the MSCI ACWI, and the Russell 3000 — alongside almost 60 other indices spanning a myriad of geographies, market capitalizations, and target markets, all tell a very similar story: that excluding or underweighting fossil fuels has led to superior performance since 2014, and over a range of other time periods. Even taking the sector’s historic post-Russia/Covid profits into account, fossil fuels have lost investors’ money.

The report, and other recent IEEFA analyses, discuss several reasons behind this trend. There’s internal competition and instability within the fossil fuel sector. There’s the uncertainty of geopolitical destabilization. And there’s the unmistakable signal of the energy transition as it begins to reshape investor expectations, and as the fossil fuel industry feels the heat of competition from low-carbon alternatives. What emerges is the story of an industry whose days of low-risk reliability are gone. In its place is a sector whose future outlook is clouded by uncertainty, and which is increasingly reliant on external volatility and geopolitical disruption to produce profits — the polar opposite of a stable, blue-chip bet.

But there’s good news, too: over the same decade, the report finds, the market for lower-carbon equity indices has matured significantly. These new indices are proving investable, passing fiduciary tests, meeting returns targets, and being adopted by major institutional investors. Across the market, leading financial actors are converging on the determination that passive investing is not at all incompatible with careful climate risk mitigation. The tools are there for investors who want to begin addressing their passive portfolios’ climate exposure. Other financial analysts have similarly concluded in recent years that passive strategies are more than capable of supporting risk-informed rebalancing decisions.

Climate risk is systemically interwoven throughout the economy, and traditional energy is far from the only sector exposed to these shifting sands. It is, however, a particularly paradigmatic example, given its disproportionate proximity to both the causes and effects of climate-related financial uncertainty. And it is a striking illustration of the need for broader portfolio-wide preparedness. As ratings agencies, economists, financial analysts, market watchdogs, and regulators warn that the energy transition could produce major losses for the most carbon-reliant assets, passive investors cannot afford to ignore these trends.

So will they act? Some funds are lagging. In California, for example, one finds a strange sight: Even as the state seeks net-zero by 2045, as the state’s Attorney General sues big oil companies for misleading the public, and as its financial regulators warn of asset impairment amidst the energy transition, pension funds CalPERS and CalSTRS continue to vociferously defend their fossil fuel holdings. This amounts to billions wagered on oil and gas — even as peer investors cut exposure, citing risky outlooks and a lack of responsiveness to investor concerns (with Exxon’s lawsuit against its own shareholders as just the latest example of the industry’s longstanding unwillingness to listen). It’s no surprise that the funds fail to satisfy all manner of other best practices in climate-related portfolio stewardship as well, according to a recent report card by the Sierra Club and the Climate Safe Pensions Network.

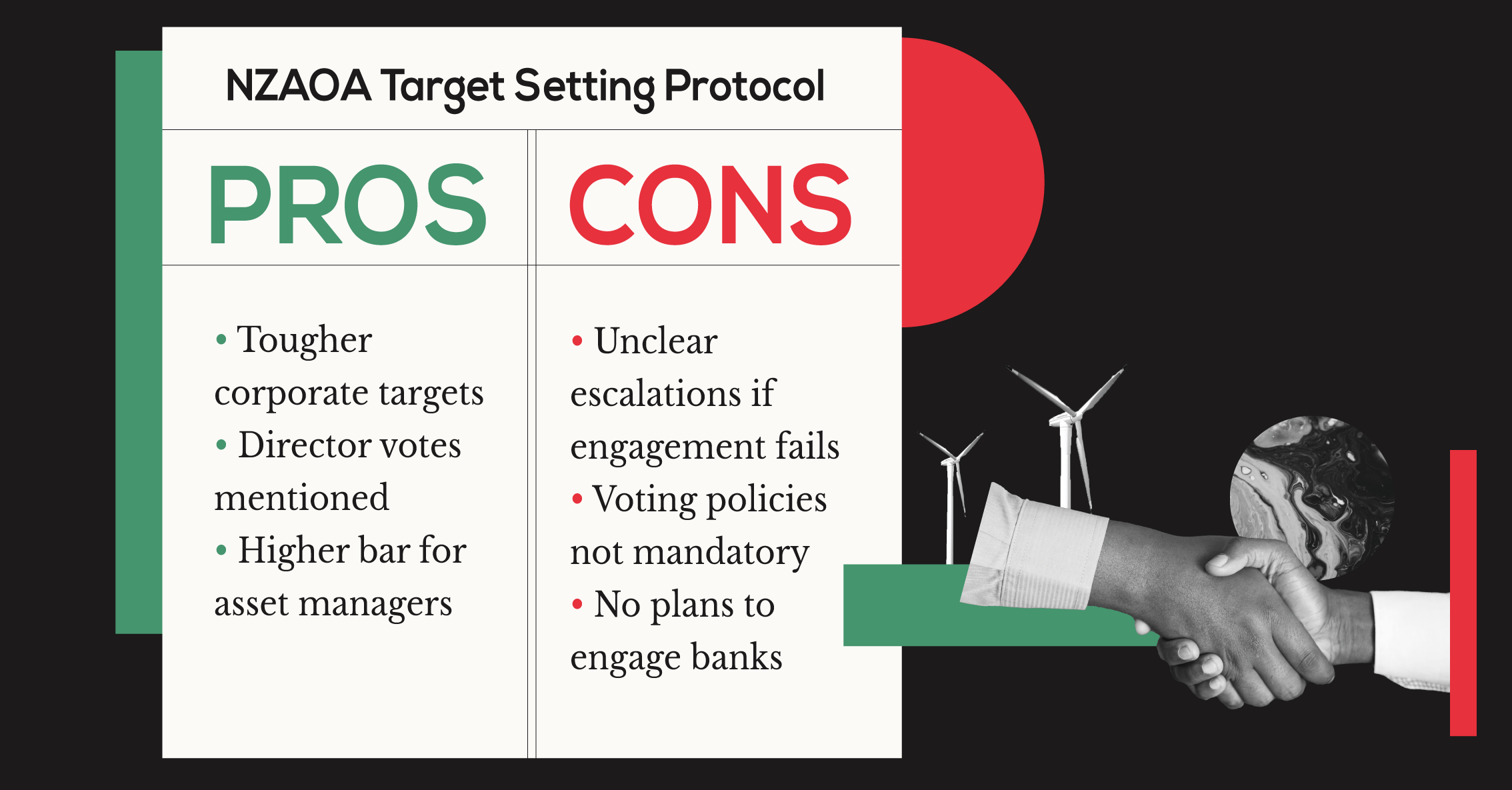

Others are leading. The IEEFA report notes how funds in New York City, for example, have used fossil fuel divestment commitments as a foundation to build market-leading climate readiness strategies. (Whereas the hottest question in climate finance was once engagement or divestment, the consensus from standard-setters today is that it’s and — that any credible stewardship strategy needs escalation pathways to be successful and off-ramps to protect portfolios when counterparties fail to listen.) In practice, the report notes, public equity reshuffling has enabled broader stewardship efforts, historic action in debt and private equity markets, and other action to reduce system-wide transition misalignment.

As the Federal Reserve has warned, “climate change poses significant challenges for the global economy and financial system,” with potentially grave consequences for “the structure of economic activity” and “the stability of the financial sector more broadly.” Passive strategies are no safe haven from these risks, and institutional investors who fail to act are at risk of being caught flat-footed. But as the energy transition continues to reshape markets, fiduciaries also have an opportunity to lead. A climate response in passive portfolios is a key step towards future-readiness.

Share