We need pension funds to take the lead in the race to net zero.

Currently, most pension funds invest in fossil fuels. But, they can be the driving force we need to avert the worst impacts of the climate crisis.

Some pension funds recognise the risks associated with their investments and have taken action in response to the climate crisis. The most recent example is the decision of the Church of England pension fund to divest from major fossil fuel producers. Others are part of the growing trend of asset owners voting in favour of climate-related resolutions at annual general meetings (AGMs). These resolutions increasingly require companies within their portfolios to commit to crucial climate actions, such as phasing out fossil fuels, setting sufficient emission reduction targets, and adopting Paris-aligned transition plans.

Why are pension funds uniquely positioned to drive climate action?

Across the 22 largest pension markets, pension funds hold $47.9 trillion in pension assets, accounting for 62% of their economies’ GDP. This substantial capital makes pension funds the custodians of the majority of global assets and enables them to exert significant influence across various financial institutions, regulators, corporations and governments through their widespread investment.

This position of power can be leveraged for meaningful progress in the fight against climate change by aligning business practices with the growing recognition that climate risk is a financial risk. Pension funds can actively demonstrate stewardship by utilising escalation pathways to signal to the global financial system that rapid transition is necessary. Importantly, this reaffirms that managing risk is not only about climate concerns, but also about ensuring financial and economic security.

An escalation pathway equips all institutional investors, including pension funds, with an array of tools to hold corporate boards accountable for climate-related matters. These tools include writing open letters, submitting shareholder resolutions, voting against directors, implementing proxy voting policies aligned with the 1.5°C target, publicly explaining voting decisions, pre-declaring proxy votes, and potential legal action and divestment. These measures aim to enhance accountability and promote positive climate action within companies.

Lastly, preparing for future risk is wise and conveys a responsible business model. It enables pension funds to seize the numerous opportunities presented by the energy transition which are in the interests of their beneficiaries.

Pressure through pre-declarations

Pre-declaring AGM voting intentions is an increasingly popular approach among pension funds that could drive widespread climate action and represents a crucial step toward transparency. Pre-declarations publicly indicate support for specific resolutions, highlight important issues, and can generate voting momentum among other financial institutions prior to the AGM.

This strategy should be considered by more pension funds, though its application may ultimately depend on their history of engagement with the company or the resolution at hand.

Voting in favour of the energy transition

Among the various tools that pension funds employ to drive climate action, one of the most common approaches is filing and voting on pro-climate resolutions aimed at advancing company decarbonisation at AGMs. A pivotal step is filing and voting for resolutions that call for the adoption of credible emission reductions (short, mid, long-term) and transition plans aligned with the 1.5°C target.

When combined with providing the rationale behind resolutions at AGMs, and voting against board members who continuously do not address systemic climate risk, pension funds demonstrate their dedication to climate action.

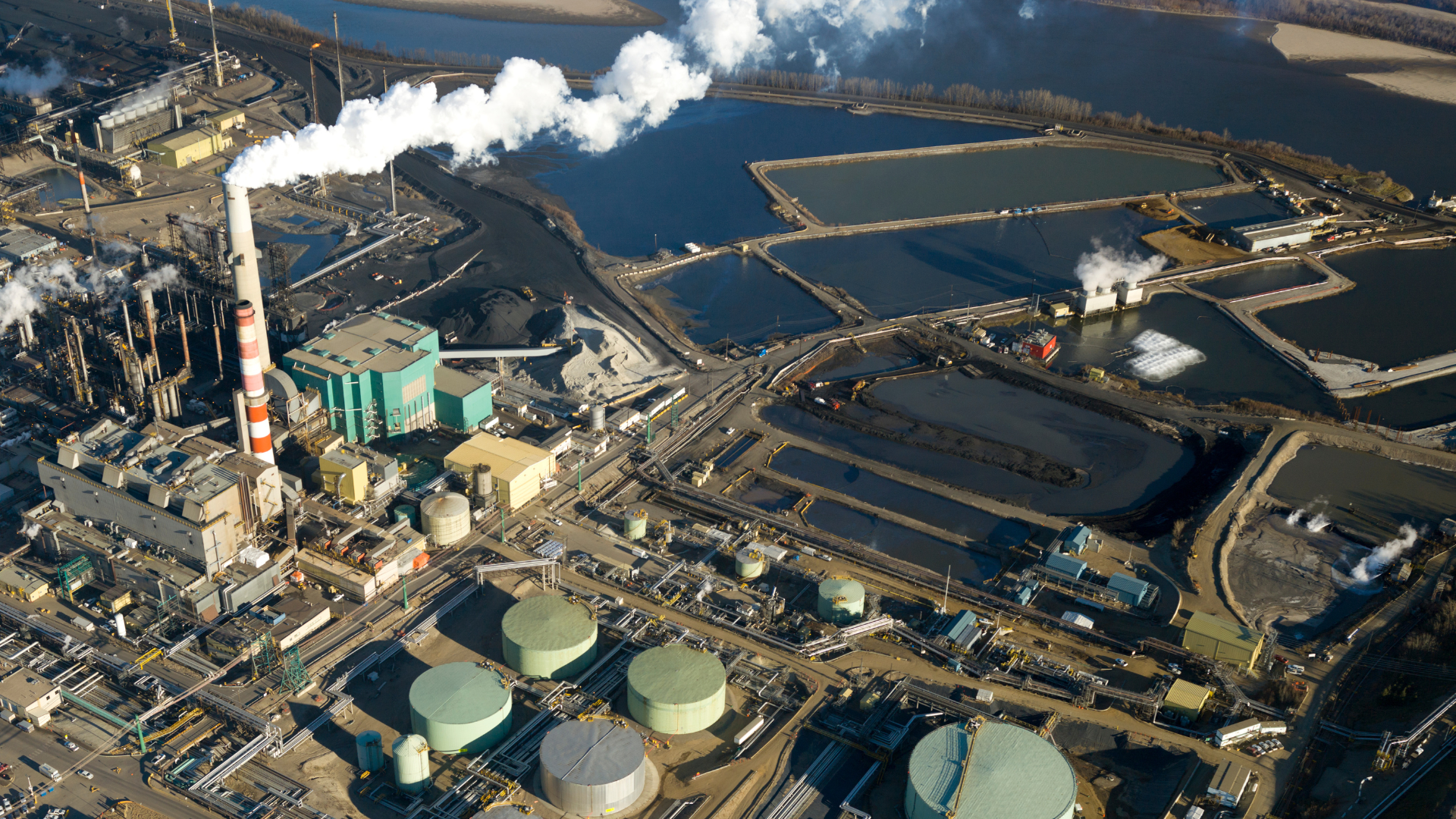

Reducing exposure to heavy polluters as a strategy

Pension funds frequently engage with companies that are lagging behind in the implementation of decarbonisation measures. In such cases, divestment is appropriate, unless the company ceases new fossil fuel projects and announces a comprehensive phase-out strategy aligned with the 1.5°C scenario timeline that has been certified by globally recognised climate scientists.

Divestment is a tool that pension funds can wield to help fight climate change. By reducing the fund’s exposure to heavy emitters, pension funds send a strong message and showcase leadership in the transition away from harmful industries that face obsolescence. Moreover, redirecting capital away from fossil fuel assets to renewable energy can enhance financial security for pension funds.

What lies ahead for pension funds?

Pension funds exist to provide everyday individuals a safety net to retire in a stable environment with economic security. When they fail to support climate action, pension funds neglect their responsibility towards pension holders’ retirement savings.

To propel climate action to the next level, pension funds must adopt dynamic strategies to address the climate crisis. By uniting their efforts and leveraging their influence, pension funds have the potential to drive significant change and serve as powerful catalysts for climate action, not only among other asset owners but throughout the global financial system as a whole.

Share