Coal mining companies Exxaro Resources Limited and Thungela Resources Limited have refused to table non-binding, advisory shareholder resolutions filed by Just Share, Aeon Investment Management, and Fossil Free South Africa, ahead of Exxaro’s 18 May and Thungela’s 31 May AGMs.

On 19 April, Just Share, Aeon Investment Management, and Fossil Free South Africa filed non-binding, advisory shareholder resolutions at Exxaro and Thungela. The resolutions ask that, in accordance with the Global Standard on Responsible Climate Lobbying, the companies report to shareholders, on the alignment of their own lobbying and policy engagement activities, and those of the industry associations to which they belong, with the goals of the Paris Agreement.

Neither company has provided a justifiable reason for refusing to table the resolutions, effectively denying shareholders the opportunity to express their opinion on a crucial issue.

Shareholders’ rights

The co-filers of the resolutions dispute that directors of South African listed companies have discretion to refuse to table shareholder-proposed resolutions that comply with the procedural requirements of the Companies Act. According to a legal opinion obtained by Just Share, a board cannot refuse to table resolutions simply because they do not like the substance of the resolution. This is particularly the case in relation to advisory resolutions which are not binding on the company even if shareholders vote in favour of them.

The filing and tabling of shareholder resolutions requesting disclosure on corporate climate lobbying is common in the USA, Canada, Europe, and Australia.

Thungela stated that its disclosure of industry association memberships in its Climate Change Report would satisfy the request of the resolution. This is disingenuous. The resolution makes clear that the disclosure required is much more detailed than simply providing names of industry associations, which is all that Thungela’s report does. As such, it does not align with the Global Standard, nor does it even comply with the Johannesburg Stock Exchange’s guidance on climate change and sustainability disclosure in relation to lobbying activities.

Thungela also claimed, in our view falsely, that the shareholders had no right to file the resolution which “falls exclusively within the power and discretion of the board of directors”.

Exxaro’s response similarly stated: “we firmly believe that the Proposed Resolution is within the purview of the directors of the Company and hence should be addressed accordingly”. A “firm belief” does not constitute a legal or otherwise justifiable ground for refusing to table a non-binding shareholder-proposed resolution.

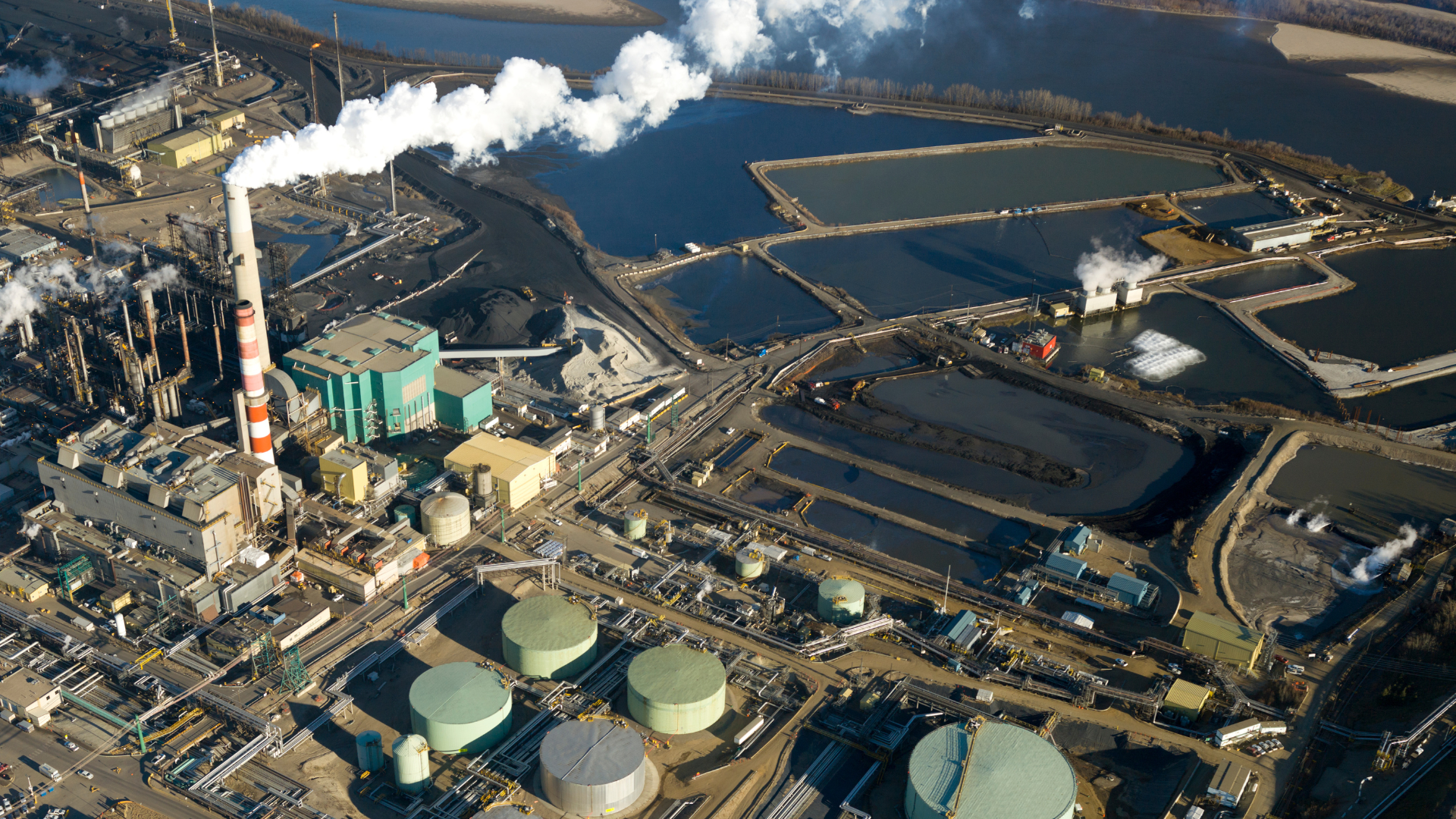

Corporate climate lobbying

Keeping the global average temperature rise to 1.5°C is essential to limit the worst impacts of global heating. This is only possible with immediate, rapid, and large-scale reductions in greenhouse gas (GHG) emissions. In South Africa, like all of sub-Saharan Africa, the impacts of climate change will be disproportionately felt by poor and marginalised communities, exacerbating the country’s already extreme poverty, inequality and unemployment.

Corporate lobbying that is inconsistent with global climate goals presents regulatory, reputational and legal risks to companies and investors. It also presents systemic risks to the South African economy, as delays in implementation of the Paris Agreement increase the physical risks of climate change, exacerbate energy instability, and hinder South Africa’s standing in the global economic community, impairing the country’s access to transition financing and introducing uncertainty and volatility into investment portfolios.

Disclosure, therefore, is particularly important for coal mining companies with a clear vested interest in delaying government climate action. Thungela, for example, is a member of the World Coal Association which, according to InfluenceMap, engages negatively on climate policies and “appears generally oppositional to ambitious global climate change policy”. Exxaro holds membership in a number of key industry associations which have lobbied, and continue to lobby the government, in order to weaken and delay the implementation of key climate-related regulation and policies.

In South Africa, obstructive corporate climate policy engagement is delaying ambitious climate policy and putting the country’s climate goals in jeopardy, presenting significant escalating risks to companies and investors. “Policy capture” (steering policymaking away from the public interest in favour of a specific interest group or individual) is particularly acute when there is limited transparency in the policy-making process.

Investors need clear information, through transparent disclosure, on how companies’ direct and indirect policy advocacy efforts align with their own climate targets and with global climate goals. If the directors of South African companies are unwilling to adhere to such simple standards of corporate governance, they should be prepared for investors to escalate their strategies, including holding the directors personally accountable by voting against their reelection.

Share