Climate Votes today publishes a new report examining the Net Zero Asset Owners Alliance (NZAOA) climate voting records and proxy voting, finding that overall, transparency is low and few members exercise their share voting rights.

Our analysis found that being a member of NZAOA does not correlate with an increase in direct pro-climate voting compared to that of those not in the alliance.

At COP26, The Glasgow Financial Alliance for Net Zero (GFANZ) took centre stage and demonstrated the influence financial institutions have in defining climate action. Members of the UN convened Net Zero Asset Owners Alliance (NZAOA), which exists under the GFANZ coalition, were complicit in continuing nothing more than voluntary decarbonisation policies and, worse, supporting fossil fuel expansion.

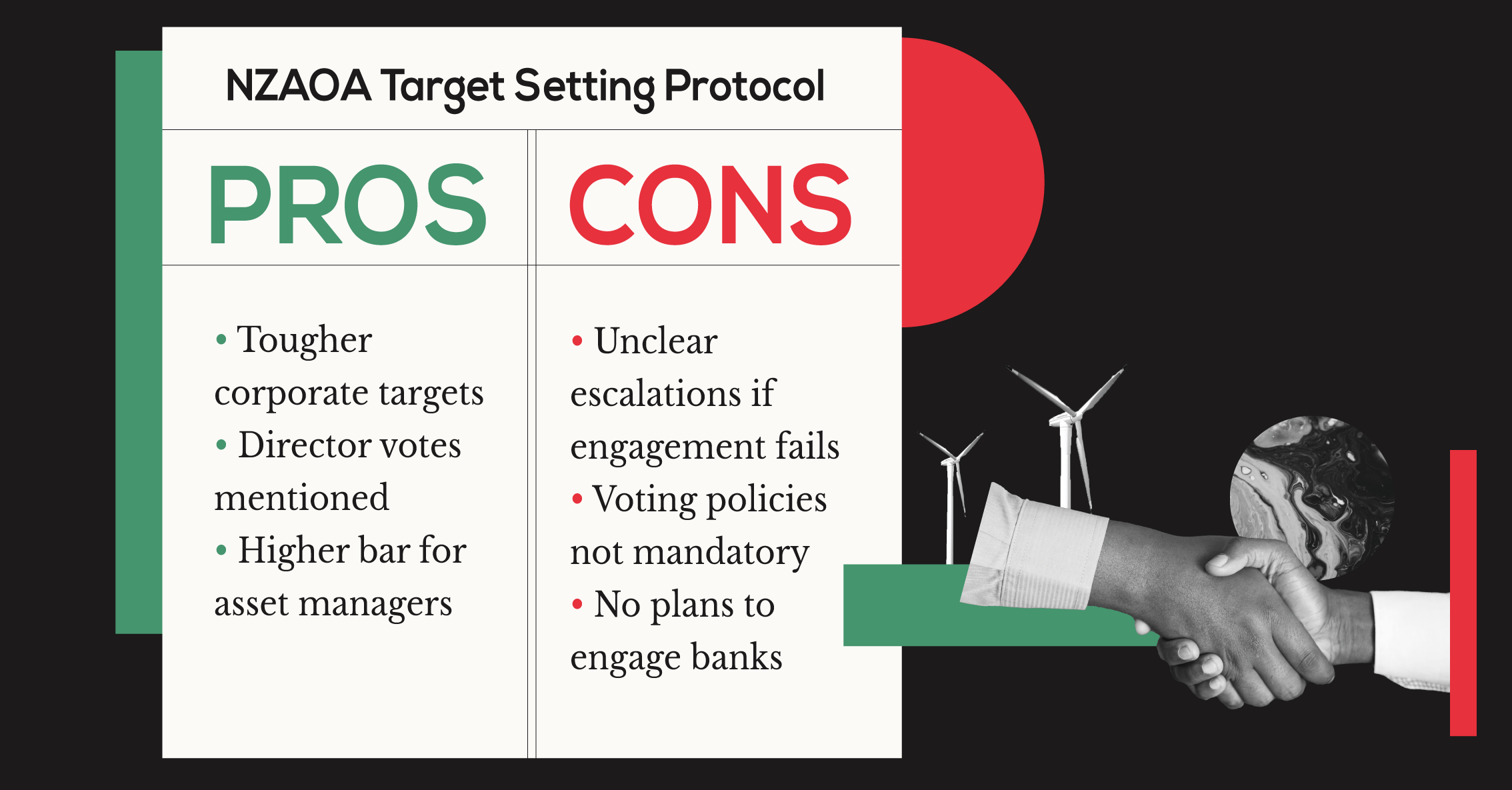

Asset owners have a very important role to play in influencing companies to accelerate action on climate change, through their asset allocation decisions, but equally through their stewardship activities, in particular voting the shares they hold. They can also influence asset managers, governments and other important entities. In that context, the Net Zero Asset Owners Alliance (NZAOA), created in 2019 and now part of the larger Glasgow Finance Alliance For Net Zero, offers huge potential.

This study analyses the direct climate voting activities of the 46 institutional investors which are part of the NZAOA as well as the proxy voting practices outlined in their 2020 PRI Transparency reports for year ending 31 December 2019. Using data from their latest PRI reports as well as data from ProxyInsight, we find that overall, transparency levels with respect to the voting practices of NZAOA members are low. Very few have publicly observable climate votes that have been cast directly by them.

In the analysis, we found:

- Voting data from ProxyInsight revealed that out of 46 asset owners part of the NZAOA (the number of members as of the start of the study – September 2021) only 13 asset owners directly exercise their share voting rights on climate related shareholder proposals.

- NZAOA members were early adopters of strong climate stewardship, however joining the NZAOA does not result in asset owners improving their voting in favour of climate resolutions more than peers in the non-NZAOA group.

- Asset owners (both the NZAOA and non-NZAOA group) are more likely to vote in favour of climate resolutions at fossil fuel companies. However, this voting behaviour does not apply to ambitious climate resolutions that call for Paris-aligned strategies at major oil & gas companies.

- A large proportion of NZAOA members provide little insight into how their voting mandates are being exercised by service providers.

- Lack of transparency on securities lending programme could further exacerbate the potential of an asset owner’s votes not getting exercised responsibly.

Recommendations include:

- Asset owners in the NZAOA and similar initiatives should align their proxy voting with the goal of limiting global warming to 1.5°C in alignment with the International Energy Agency’s Net Zero pathway.

- Asset owners should develop and publicly disclose escalation policies, and make transparent in a timely manner how their shares are voted, whether directly or by service providers on their behalf indirectly all elements of their voting outcomes.

- Asset owners should track, monitor and disclose how votes are exercised on their behalf. Asset owners should commit to holding asset managers accountable if the asset manager fails to represent their climate voting values and commitments. This includes finding alternative asset managers if needed.

- Future versions of NZAOA’s Progress Report should provide more detail on the issues covered by this report.

Read the full report to learn more about how the NZAOA voted and our recommendations on what they can do to improve.

Share