Investors fail first test on climate risk accounting

Thirty-four investors managing over $7 trillion in assets have written to board directors at 17 European companies warning that they may vote against Audit Committee directors’ reappointments if they fail to account for climate risks in their financial statements.

But at today’s annual general meeting of CRH, a FTSE 100 construction products company, investors failed the first test of this initiative. 97% of investors who voted backed the reappointment of both the auditor – Deloitte – and the audit committee chair – Shaun Kelly.

This was despite the fact that these votes had been “flagged” by Climate Action 100+ (CA100+), which now counts 700 investors as members. A press release explains that “the flagging escalates a campaign to address the repeated failure of corporates to meet investor expectations over climate accounting”.

These expectations, published in 2020, call on company directors to affirm that the goals of the Paris Agreement have been considered in drawing up the accounts. They further ask them to explain how critical accounting judgments are consistent with achieving net zero carbon emissions by 2050 and with narrative reporting on climate risks.

Natasha Landell-Mills, Partner and Head of Stewardship at Sarasin & Partners, is one of the authors of the IIGCC expectations. She explained the case for investors to uphold these expectations by voting against CRH:

“Despite a long-standing engagement by investors, CRH’s accounts have failed to provide visibility on how its financial position would be impacted by the global transition onto a 1.5C pathway. Shareholders clearly need to understand how its assets, liabilities and profitability could be resilient to, for instance, rising carbon taxes, requirements to capture hard to abate emissions, or other likely policies”.

She concludes “Put simply, capital deployment will only be aligned with a 1.5C pathway when the numbers are aligned with this pathway”, noting that “global regulators and standards setters have made clear that, under existing rules, material climate risks must be incorporated into company accounts”.

The flurry of investor statements ahead of CRH’s AGM picked up some media coverage, including in the Sunday Times and City AM. But some of this coverage exaggerates the nature of CA100+ vote flagging campaigns, only 6 out of 14 of which attracted more than 50% of investor backing last year.

And today’s weak vote at CRH is in line with the findings of a recent report. A few months ago, Greenpeace UK reviewed 2021 AGM votes on the issue of auditor appointments at the UK’s largest listed companies as well as at some of the world’s largest carbon emitters. Their report found “such appointments are waived though with few objections of any kind and negligible references to climate-related concerns…, shareholders voted by 90% or more to appoint the auditors at all but 3 of 349 large listed companies which disclosed full voting results”.

The report showed how many investors were missing in action on this issue. For example BlackRock, “voted only against one auditor (despite having a policy saying it may vote against auditors if climate risk is not reflected in financial reporting)”; and State Street Global Advisors only voted against three auditors.

Later this year, Greenpeace will again review the audit-related votes at CRH and other CA100+ companies, faming or shaming investors as appropriate.

Let’s hope that at least all 34 of the investors who co-signed the recent letters vote in line with their warnings at many of the 17 companies they wrote to. The investors include HSBC Asset Management, ERAFP – a French public pension scheme, and BMO Global Asset Management.

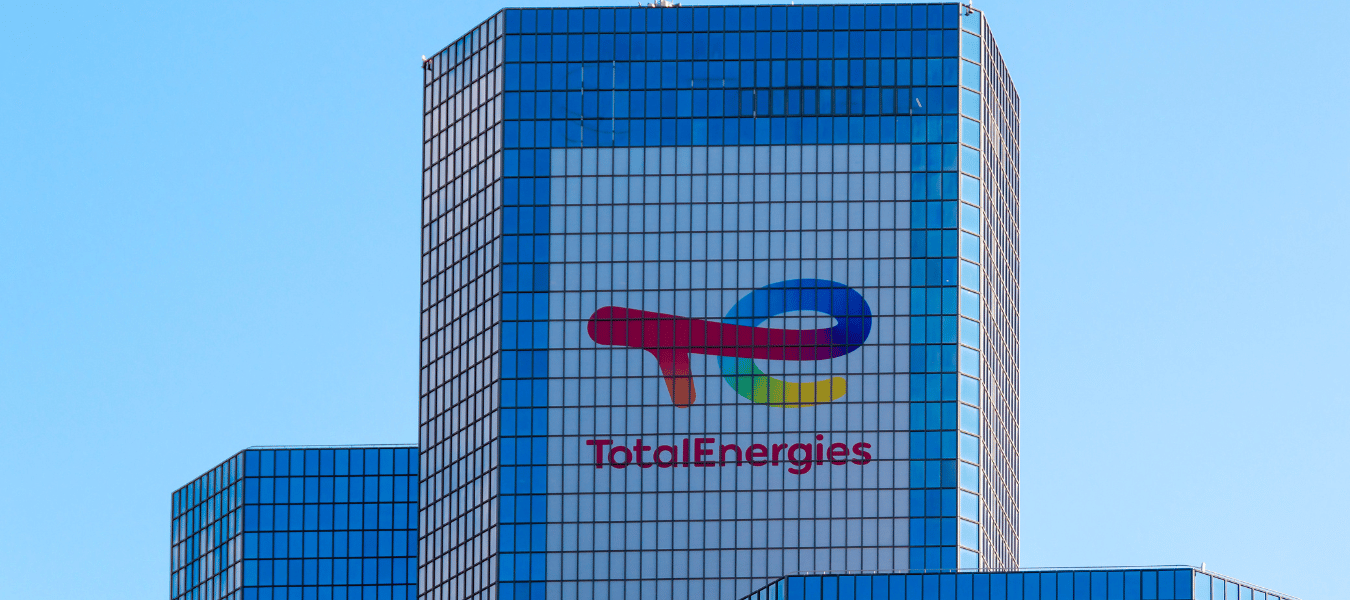

Other companies that received the investor letter on climate risk accounting include BP, VW, Air Liquide, Anglo American, Arcelor Mittal, BMW, Daimler, Enel, Equinor, Glencore, Rio Tinto, Saint-Gobain, Shell, Renault, ThyssenKrupp and TotalEnergies.

The Climate Accounting and Audit Project is updating its 2021 “Flying Blind” analysis for these companies. Their full analysis of CRH’s 2021 financial statements is here.

Share