The invasion of Ukraine is the latest, devastating example of how fossil fuels don’t just cause climate change but drive conflict and violence across the world. As financiers of the fossil fuel industry, banks are now under even greater pressure from climate and anti-war movements.

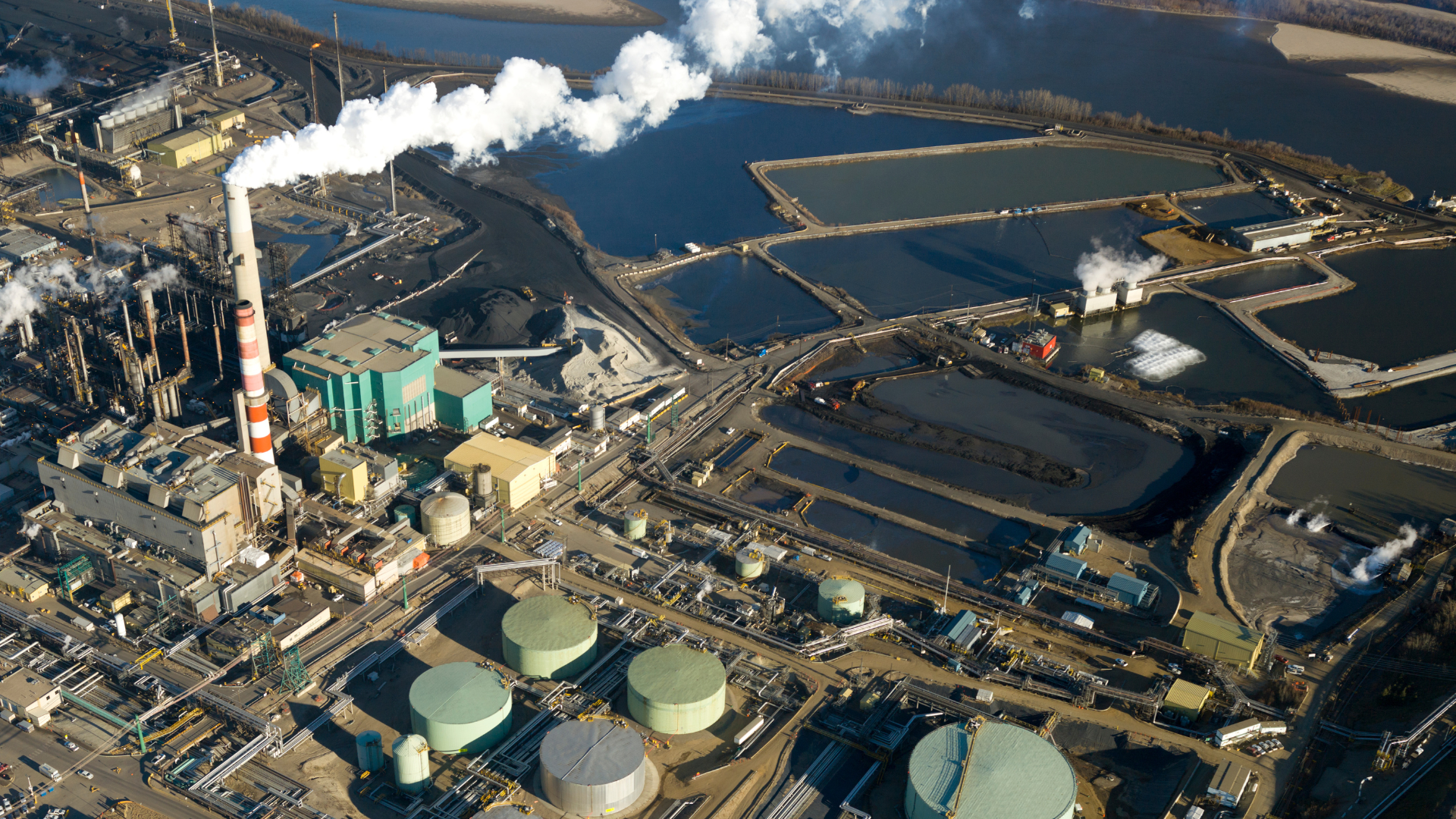

In fact, the recent Banking on Climate Chaos report reveals that fossil fuel financing from the world’s 60 largest banks has reached nearly USD 4.6 trillion in the six years since the adoption of the Paris Agreement, with USD 742 billion provided in 2021 alone.

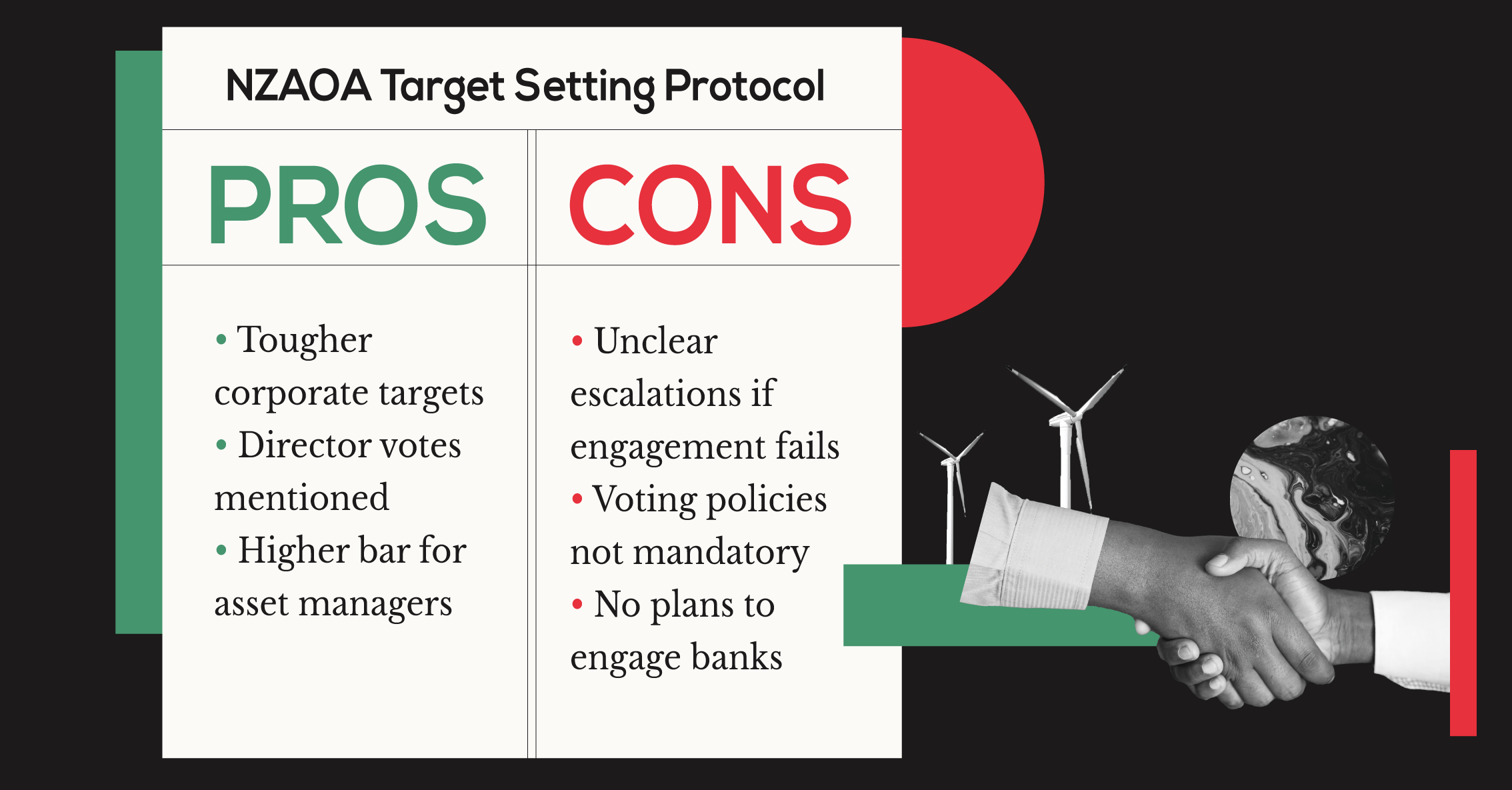

According to climate researchers at InfluenceMap, just 11 of the 30 of the world’s 30 largest listed financial institutions have set reliable goals for slashing greenhouse gas emissions across multiple sectors by the end of this decade. 29 of the 30 institutions were committed to the Glasgow Financial Alliance for Net Zero (GFANZ), which requires them to slash short-term emissions.

Alarmed by the scale of banks’ financing of fossil fuels, several of their investors filed climate resolutions to encourage the banks to cease funding to new fossil fuel facilities and infrastructure this year. The 2022 AGM season has seen a significant increase in investors filing ‘no fossil fuel expansion’ resolutions at banks worldwide. These investors argue that new fossil fuel development investment is not aligned with a pathway to limit warming to 1.5°C. The International Energy Agency (IEA) made this point clear last year, which concluded that there could not be an investment in a new fossil fuel supply in their net-zero pathway.

Despite being GFANZ members, banks like Citibank and JPMorgan Chase continue to lead from the bottom. Between 2016 and 2021, they have financed fossil fuels with a whopping USD 660 billion.

Citibank has not committed to ending funding of fossil fuel expansion. It reportedly recently financed an expanding coal operation in Russia. In September 2021, Bloomberg reported that Russia’s largest coal producer and coal plant operator, JSC SUEK, had mandated nine banks, including Citibank, for a bond issuance with a 5-year maturity. JSC SUEK produces over 100 million tons of coal per year. It is expanding coal mining operations by 25 million tons per year. SUEK’s coal exports are set for expansion by around 28 million tons per year.

According to data from the Banking on Climate Choas report, JPMorgan Chase is the largest global banker of Gazprom, the largest state-owned Russian energy company. The report says that between 2016 and 2020, JP Morgan Chase provided Gazprom with roughly USD 3.5 billion in financing.

Harrington Investments has filed resolutions at Citibank and JPMorgan Chase’s annual general meetings on April 26th, 2022. Both resolutions ask the banks to adopt a policy by the end of 2022 committing to proactive measures to ensure that the bank’s lending and underwriting do not contribute to new fossil fuel supplies inconsistent with fulfilling the IEA’s Net Zero Emissions by 2050 pathway.

2022 will be the litmus test for the investors and whether or not they will accelerate support for climate action in boardrooms at the scale and rate that we need to address the climate crisis.

During this upcoming shareholder season, investors and asset managers must take a stand against fossil fuel expansion in their voting. According to the latest IPCC report, more than 3 billion people are now highly vulnerable to climate disasters due to our failure to slash fossil fuel emissions. For investors, the takeaway from these harrowing scientific findings should be clear: they have to support shareholder climate resolutions filed both at the heavy emitters expanding their fossil fuel production and at the banks funding them.

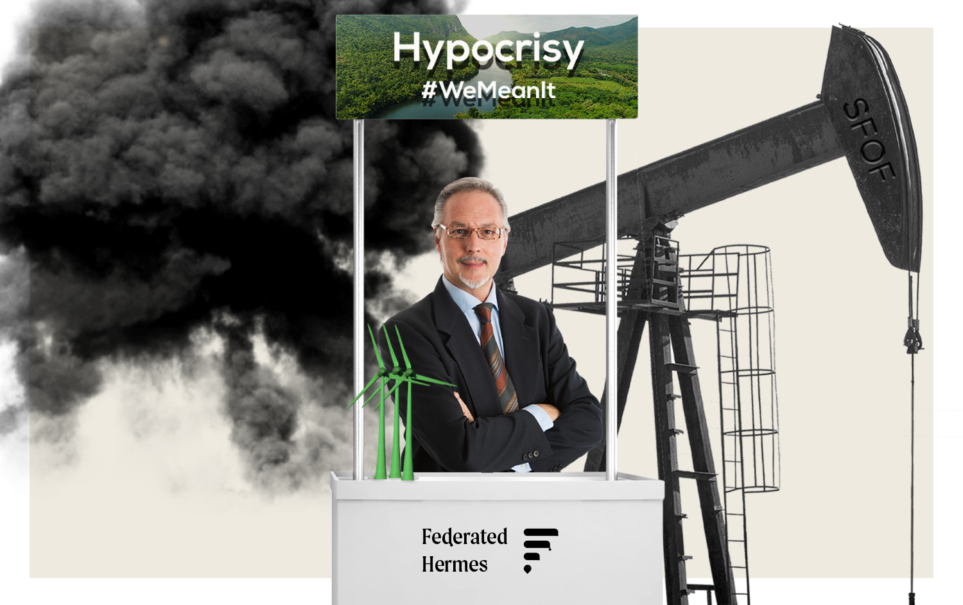

How GFANZ members vote at the annual general meetings of the big fossil fuel funding banks will be the litmus test for their climate commitments. Investors who fail to support the climate resolutions on the ballot are voting to maintain business as usual, allowing banks to get away with greenwashing their fossil profiteering.

Share