Climate Votes today publishes a new report examining the Net Zero Asset Owners Alliance (NZAOA) members’ disclosure, proxy voting and fossil fuel bond investing.

Our first annual 2021 analysis of 46 NZAOA members showed patchy progress toward this commitment, with only 28% of members voting on climate-related shareholder proposals. NZAOA membership did not correlate with an increase in direct pro-climate voting compared to peers, and transparency around voting practices was very low.

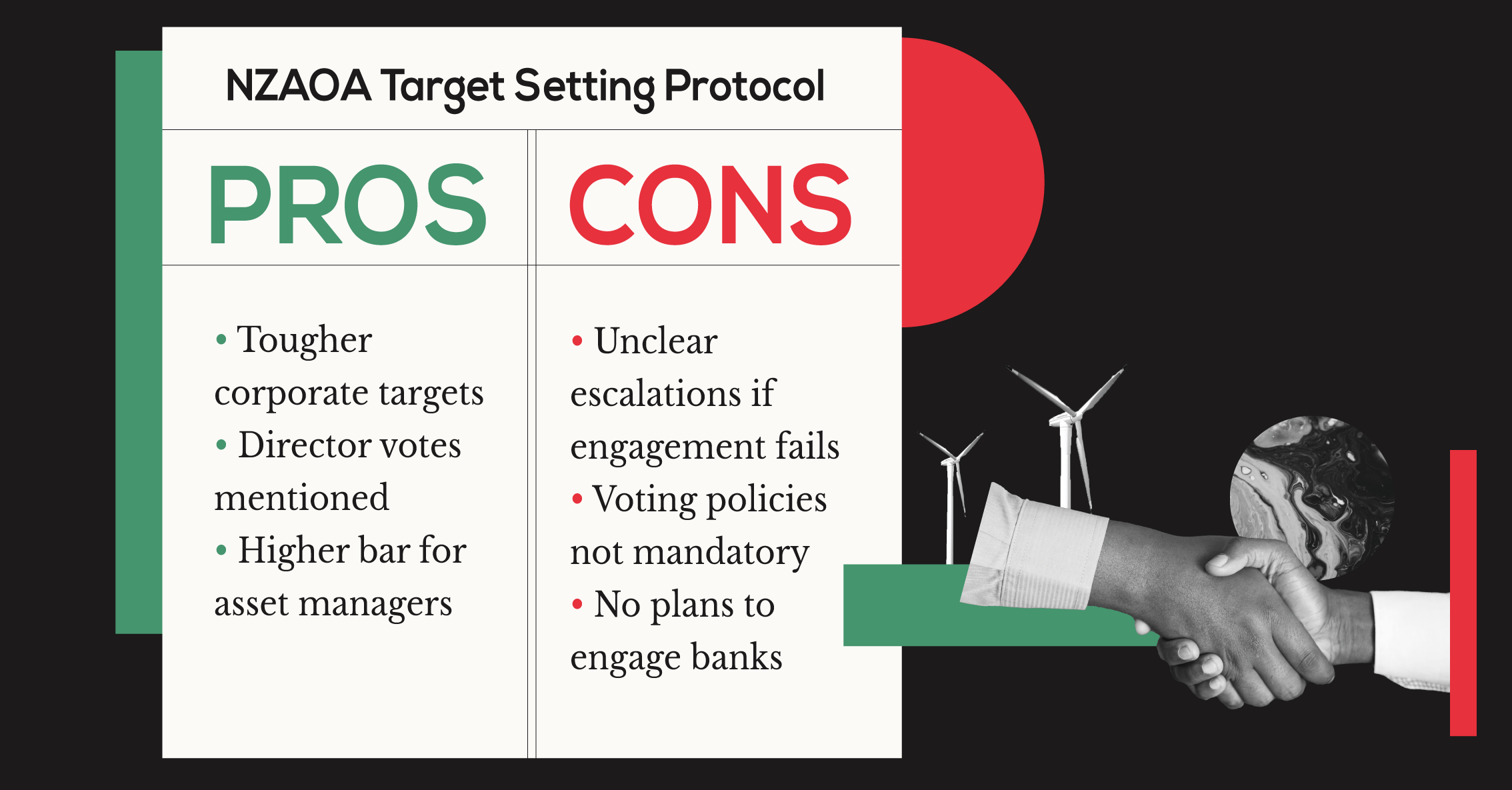

One of the seven sector-specific alliances under the Glasgow Financial Alliance for Net Zero (GFANZ), the United Nations-convened Net-Zero Asset Owner Alliance (NZAOA) is an international group of 74 institutional investors with a combined pool of assets under management (AUM) worth US$10.6 trillion. NZAOA members are committed to transitioning their investments to net-zero emissions by 2050, in line with the latest Intergovernmental Panel on Climate Change (IPCC) scientific research to follow “no or limited” overshoot trajectories to a 1.5°C scenario. NZAOA members also launched a more ambitious second edition of the Target Setting Protocol (TSP2) at the beginning of 2022. The TSP2 includes objectives for increased engagement, transparent reporting, and emissions reduction and target setting.

Our first annual 2021 analysis of 46 NZAOA members showed patchy progress toward this commitment, with only 28% of members voting on climate-related shareholder proposals. NZAOA membership did not correlate with an increase in direct pro-climate voting compared to peers, and transparency around voting practices was very low. This year, we repeated the study for 73 NZAOA members using updated data for 2022. We assessed NZAOA members on their net-zero implementation progress, proxy voting on climate resolutions, and bondholding exposure to fossil fuels. This was evaluated through three interrelated analyses:

1) Climate disclosure practice in publicly issued statements and reports;

2) Climate voting performance by comparing Principles for Responsible Investing (PRI) signatories with NZAOA peers (similar to the 2021 study); and

3) Fossil fuel bondholding behaviour through proportionality analyses using Bloomberg data.

These analyses aim to provide an overview of the different actions NZAOA members take or pledge toward net-zero alignment. The first part of the study examines what individual NZAOA members claim on their websites, as well as on their annual, sustainability, or stewardship reports and how those match the alliance’s TSP2 objectives. However, members’ claims are not sufficient to judge the initative’s performance, and hence, to ground truth in some of the claims, we conducted two deep dives on their actual climate resolution voting patterns. We also sought to piece together their fossil fuel bond holdings, which, as of 2020, is the key asset class through which new fossil fuel infrastructure projects are funded. These deep divest are crucial, as we investigate both elements of stewardship, as well as the funding channel that is most likely to help phase out fossil fuels.

Share