Climate Votes has published an investors briefing highlighting the banking sector’s high exposure to climate-related risks and identifies actionable opportunities that investors can take this AGM season to encourage mitigation of these risks in their holdings.

The analysis focuses on eight North American financial institutions that face unique and serious climate risks due in part to their outsized exposure to fossil fuels:

- Bank of America

- Citibank

- Goldman Sachs

- JPMorgan Chase

- Morgan Stanley

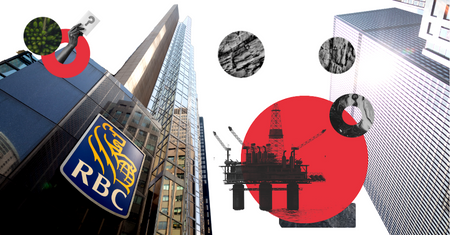

- Royal Bank of Canada

- TD Bank

- Wells Fargo

These banks alone financed $1.8 trillion to the fossil fuel industry during the six years following the Paris Agreement (2016-2021). Each of the banks profiled is a member of the Net Zero Banking Alliance (NZBA), which commits them to aligning their portfolios with net zero emissions by 2050. Since these banks joined NZBA in 2021, they have financed over $100 billion to coal, oil, and gas developers alone.

Investors can encourage banks to lower their exposure to climate risk this shareholder season by taking the following proxy voting actions:

- Phaseout of new fossil fuel exploration and development financing: calls on banks to phase out underwriting and lending to projects and companies engaging in new fossil fuel exploration and development that is misaligned with 1.5 ̊C pathways.

- Transition planning: calls on banks to disclose a transition plan with interim steps, metrics, and timelines to reduce financed emissions in line with the Paris Agreement.

- Absolute emission targets: call on banks to set goals to reduce absolute emissions for energy sector clients and, in some cases, utility sector clients as well.

- Vote against directors responsible for climate oversight: investors are encouraged to vote against the reelection of directors responsible for climate oversight at banks that have failed to align goals, lending, underwriting, capital expenditures, and strategic planning with the goals of the Paris Agreement projects.

Share